Choosing the right set of countries, sites and investigators for a clinical trial are critical success factors in any clinical development program. They can guarantee speedy patient recruitment and timely delivery of study results. It also ensures that you conduct your clinical trial within budget and avoid delays that increase the overall study costs. In this article, we describe 7 reasons why to include Eastern Europe in your Clinical Trials Strategy for Pharmaceutical, Biotechnology and Medical Device products.

There are various reasons driving Sponsor’s decision to choose one or another country/site for their study. We can divide those reasons for the decision-making into two main categories – hard and soft criteria.

- Hard criteria can be described as feasibility results, incidence of condition/disease, country/site track record of recruitment in particular indication, investigator experience, country healthcare system peculiarities (e.g., reimbursed medicines, access to certain therapies), costs of clinical trial conduct in the country, etc.

- Soft criteria can be a relationship with an investigator, attitude/beliefs of key decision-makers, lack of previous experience in certain geographies or negative perception on particular countries, etc.

While planning clinical studies and choosing the best set of countries to conduct their trials, most companies commonly consider Eastern Europe because of the following:

- Eastern Europe represents largest patient population in Europe

- Excellent patient recruitment rates

- Proven Clinical Quality Standards

- Lower density of clinical trials in CEE

- Highly experienced and motivated investigators

- Clear regulatory environment and favorable study start-up timelines

- Competitive per patient costs

1. Eastern Europe represents largest patient population in Europe

According to the data of worldometers.info, Eastern Europe, which includes Russia, Ukraine, Poland, Romania, Czech Republic, Hungary, Belarus, Bulgaria, Slovakia, and Moldova, is the largest subregion in the continent, with a total population of around 293 million citizens (1). Simultaneously, all together, these markets represent the largest patient population in Europe. On its own, this is already a significant driver for companies to consider Eastern Europe in their clinical trial strategy.

In addition, non-EU countries like Russia, Ukraine, Belarus, and Moldova have a significant number of patients who are treatment naïve in terms of some newest therapies. This is thanks to the set-up of the healthcare system in these countries and differences in reimbursement of medicines compared to the EU, resulting in lower access to innovative therapies for patients. This is extremely important in clinical trials that require a cohort of treatment naïve patients according to their study design.

2. Excellent patient recruitment rates

Every clinical trial sponsor aims for speedy and timely recruitment to ensure their clinical development program continues without delays and within budget. However, according to BioPharma Dive, 85% of clinical trials fail to recruit enough patients, 80% are delayed due to recruitment issues and high dropout rates (2).

In case of delays, sponsors can either extend recruitment timelines for enrolling sites or initiate additional countries and sites. This is where Eastern Europe frequently plays its role, becoming the primary source of rescue sites. Therefore, considering adding these countries from the beginning of the study might help mitigate the risk of recruitment delays.

Outstanding patient recruitment in the region is directly related to other reasons to include Eastern Europe in your Clinical Trials Strategy mentioned:

- large pool of patients;

- lower density of clinical trials;

- lower number of competitive studies and higher motivation of investigators to recruit patients.

3. Proven Clinical Quality Standards

There is a perception that high-quality clinical trial data can only come from Northern- Western Europe or the US. But are there any real reasons to validate the doubts regarding the quality of clinical study conduct and data collection at Eastern European sites? Definitely – no. Can we bust this myth easily? Yes! There is concrete evidence to support the fact that there is no compromise to the quality of data in the region.

An analysis of 10 years of clinical site inspection data from the US Food and Drug Administration (FDA) showed no deficiencies were noted during 16.6%, 39.0%, and 21.5% of the inspections in Western Europe, Central Eastern Europe, and US, respectively (3). The percentages of inspections that didn’t require follow-up actions were 36.9% for Western Europe, 55.7% for Central Eastern Europe, and 44.3% for US sites. CEE was also the region with the lowest percentage of inspections that required official or voluntary action.

The conclusions of this publication were confident. Based on FDA inspection data, we can state that the high productivity of CEE sites goes hand in hand with regulatory compliance and data quality standards that equal those in Western regions.

4. Lower density of clinical trials in CEE

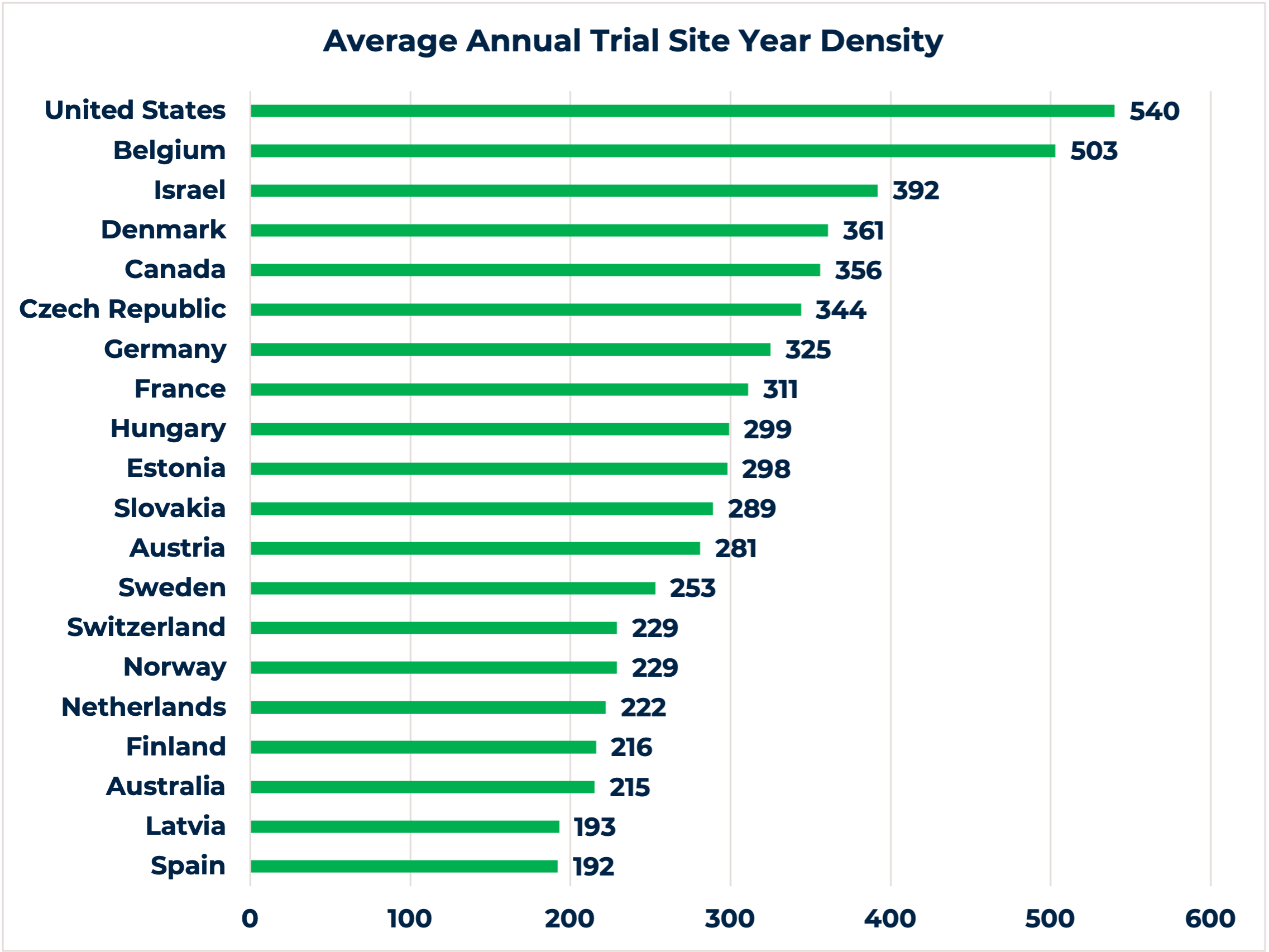

The chart demonstrates the top 20 countries globally with the highest average annual trial site year density during an 8-year period. With the exception to the Czech Republic, Hungary and Slovakia, 7 out of the 10 countries from Eastern Europe we mentioned in this article offer low annual trial density (i.e., Russia, Ukraine, Poland, Romania, Belarus, Bulgaria, and Moldova) (4).

While a lower density of clinical trials per country may not sound beneficial, it has a set of advantages for choosing such countries for clinical research conduct. Firstly, fewer studies at the clinical site also means less competitive trials, which is crucial information to evaluate before selecting a site. An ongoing competitive study might be a game-changer for timely patient recruitment, especially for orphan disease indications or clinical trials with stringent inclusion/exclusion criteria. Secondly, a lower number of studies per site can motivate investigators to recruit patients and dedicate more of their time to the trial, resulting in high-quality delivery.

5. Highly experienced and motivated investigators

One of the most important deliverables in clinical research is high-quality clinical data. It is obvious that it can be collected and delivered only by involving highly experienced and motivated investigators in your clinical trial strategy. Eastern European countries match the US and Western Europe regarding the expertise and professionalism of local investigators they offer. We need to emphasize that ICH-GCP standards are obligatory and regulated by local authorities. Clinical site inspection data can also be used as hard evidence to demonstrate the quality of clinical research delivery in the region, which directly depends on the performance of investigators and other involved site staff.

A lower density of clinical trials in the Eastern European countries also serves for the higher motivation of investigators. Investigators can dedicate much more attention to a particular study and are also highly motivated to provide their patients with innovative therapies, especially for those having no or very limited treatment options.

A lower number of clinical trials in Eastern Europe can lead to the assumption that investigators might be less experienced. However, centralized healthcare systems throughout Eastern Europe direct patients into specialized centers, usually large university hospitals. Concentration of clinical studies at these sites ensures that investigators there can offer specialized clinical research experience. Moreover, the high patient concentration at these centers/hospitals makes it easier to identify patients who meet study protocol inclusion criteria and to treat a large patient number at one site, i.e., demonstrate fast and reliable patient recruitment.

6. Clear regulatory environment and favorable study start-up timelines

Clinical trial approval is a crucial milestone to be met. While discussing the regulatory environment in Eastern Europe, we need to consider differences between EU and non-EU markets. Overall Eastern Europe offers a favorable regulatory environtment and study start-up timelines.

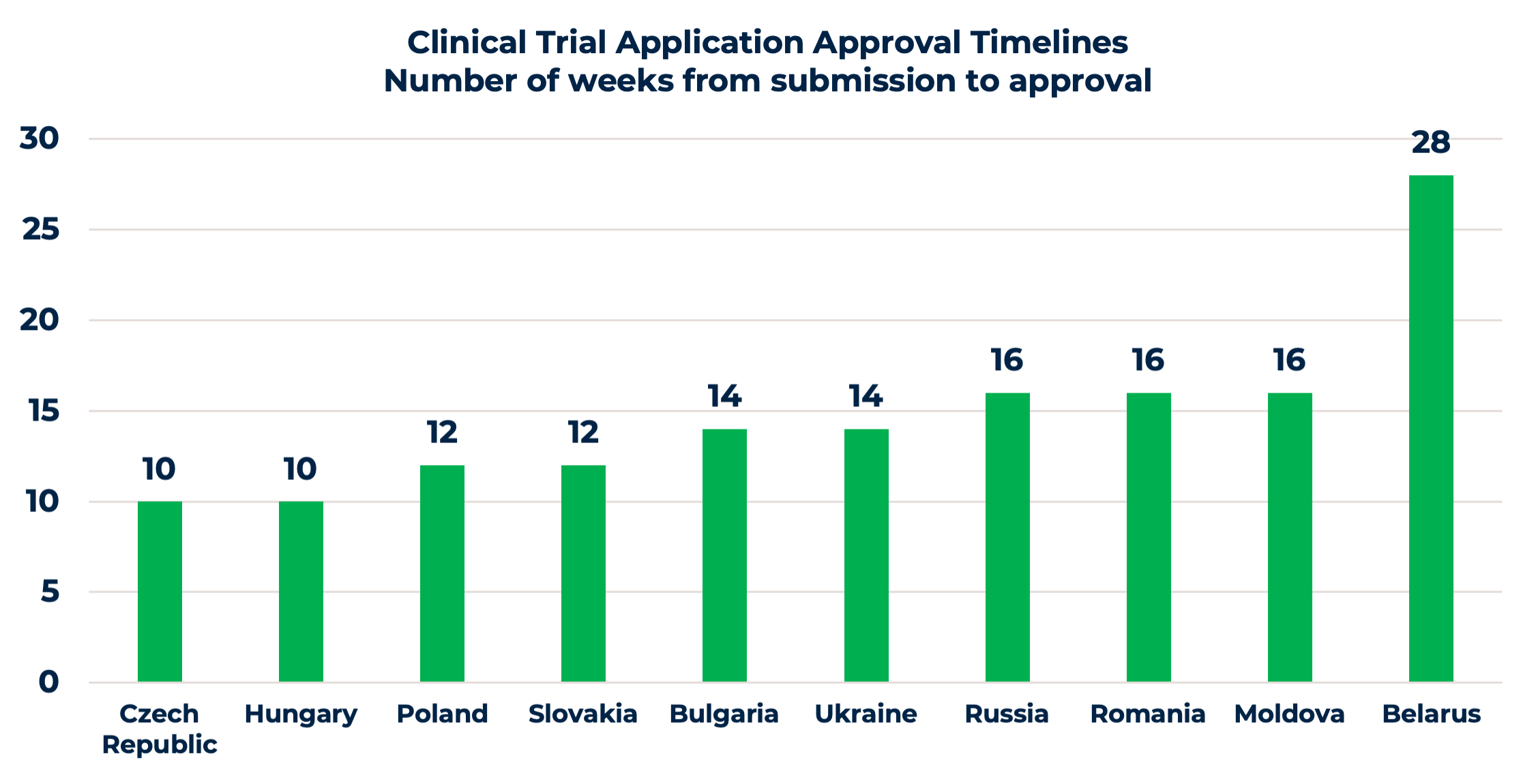

It is straightforward with EU submissions. Competent Authorities (CA) and Ethics Committees (EC) have similar regulatory requirements for clinical trial applications (CTA), with a few differences, such as national forms or site contracts. Approval timelines are quite favorable, varying from 10 to 16 weeks, as shown in the chart. Moreover, the upcoming changes and centralized CTA submissions through the EU Clinical Trial Information System (CTIS) will ease the process. Once the CTIS is in place, it will serve as a single-entry point for EU clinical trial applications and enable sponsors to obtain clinical trial approval in all European Economic Area (EEA) countries with one application.

Non-EU countries, i.e., Russia, Ukraine, Belarus, and Moldova, have several additional requirements, including translation and notarization of documents, IMP import requirements, etc. For a successful approval process, it’s highly recommended to use a clinical research organization with a local presence or to have experienced in-country staff, familiar with the local peculiarities and working practices of national CAs and ECs. Even though approval timelines are a bit longer compared to the EU, sponsors compensate this additional time spent later with savings thanks to faster patient recruitment.

7. Competitive per patient costs

The costs for clinical development and competitive per patient costs are key drivers for sponsors to look for solutions and ways to optimize the conduct of their clinical trials. Some choose to move forward with functional service provision models, outsourcing only activities that cannot be handled in-house. Some look for better suited geography, resulting in a lower overall study budget.

When it comes to the cost of a study, the expenses of labor and site fees are typically the highest in countries in Western (Germany, France, UK, Ireland, Benelux) and Northern Europe (Sweden, Denmark). Eastern European costs for labor are lower, i.e., resulting in lower clinical study budgets. The further east you conduct a clinical trial, the lower the labor costs will be and the costs of the study itself. Including Eastern Europe in your clinical trial strategy can lower costs by 20 to 40% compared to Northern-Western Europe or the Nordics, and even up to 50% compared to the US.

To sum up – Eastern Europe has a stably growing interest of clinical trial sponsors regarding study conduct in the region. Even though Eastern European countries might not be the one and only solution for all indications but can definitely and significantly benefit many clinical trial strategies. Therefore, sponsors should investigate the inclusion of clinical sites in this region in the study planning phase.

References:

- Worldometers.info (online link)

- Decentralized clinical trials: Are we ready to make the leap? (online link)

- Caldron PH, Gavrilova SI, Kropf S. Why (not) go east? Comparison of findings from FDA Investigational New Drug study site inspections performed in Central and Eastern Europe with results from the USA, Western Europe, and other parts of the world. Drug Des Devel Ther. 2012;6:53-60. doi: 10.2147/DDDT.S30109. (online link)

- Drain PK, Parker RA, Robine M, Holmes KK, Bassett IV. Global migration of clinical research during the era of trial registration PLoS One. 2018 Feb 28;13(2):e0192413. doi: 10.1371/journal.pone.0192413. eCollection 2018. (online link)

Other articles you might be interested in:

What is the Clinical Trials Regulation?

The EU CTR is the new Regulation that govers all interventional clinical trials using human medicinal products. By implementing this Clinical Trials Regulation (CTR) early 2022, the European Commission hopes to establish a better environment for clinical trials in the...

Biomapas Nordic AB Appoints Ola Jeppsson to CEO & Business Development Director

August 2021 Ola Jeppsson has taken on a leading role as Business Development Director. In addition to his new role, he was appointed as a Chief Executive Officer at Biomapas Nordic AB starting August 2021.Having a management and business development background in the...

Clinical Study Start-Up: Is there any Difference Between Western and Eastern Europe?

This article reviews Clinical Study Start-up Differences Between West & East Europe, timelines, and processes. Medicine is constantly evolving to invent effective ways to treat diseases. This progress is a never-ending process: the life science industry develops...

Running a Clinical Trial in Ukraine

Despite the fact that Ukraine is the largest country in Eastern Europe with a large population of treatment-naïve patients, well organized public health care sector and significant number of medical sites accredited for clinical trial conduction, country has utilized only 15% of its current potential for hosting clinical trials. During 2017, the European Medicine Agency (EMA) gave positive recommendations on 94 new drug applications and 49 of them were tested in clinical trials in Ukraine. During the same year, the US FDA approved 151 new drugs, and 28 of them were also studied in Ukraine.

What You Need to Know about Running a Clinical Trial in Russia?

Russia is a very perspective country for international clinical trial conduction. The first international clinical trial was set up in Russia about 20 years ago only, and from than country kept a great potential for market development. In 2018 health authorities (HAs) approved 653 clinical trials (CT) in Russian Federation, less in overall numbers compared to the same indicator from 2016 – 898 approved CTs. However, this decrease was observed across all types of clinical trials except for international multicentre clinical trials (IMCT).

The CIS Region: Excellent Potential for Patient Recruitment but is there any Risk to Quality?

The number of clinical trials worldwide is increasing more than 10% each year due to the new diseases, further research for better health products and development of new drugs. Though, for a successful clinical trial, there is a major challenge – patient recruitment, which is essential and the most challenging factor due to the increasing number of new clinical trials. In order to achieve the required patient recruitment, sponsors are looking for different solutions.

Running a clinical trial in the Baltic states

In the past five years, an average of 175 clinical trials are being initiated in the Baltic states each year. An average of 64,8% of the population in the Baltic states are in the age from 15 to 65 years old, the main target audience for clinical trials. Furthermore, a large pool of treatment-naïve subjects is available compared to other EU countries or the US. Patients with special therapeutic diseases are transferred to the main central hospitals.

Remaining Vigilant and Compliant after Brexit: What’s next? (Latest Updates)

On 29th March 2017 UK submitted the notification of its intention to withdraw from the EU. This means that UK will become a ‘third country’ from 30th March’19. Even though leaving the EU with a deal remains the Government’s top priority, UK drug agency is publishing a series of guidance documents for industry and other stakeholders covering the proposed arrangements for the regulation of medicines, medical devices and clinical trials, if UK leaves EU with no deal.

Tuberculosis Medicines Clinical Development in Eastern Europe and CIS

World Tuberculosis Day is commemorated every year on 24th March to raise awareness of tuberculosis, which is still causing death of nearly 1.5 million people each year, mostly in developing countries. It marks the day in 1882, when Dr. Robert Koch announced that he had discovered the cause of tuberculosis, the TB bacillus. In comparison to other infectious diseases caused by a single infectious agent, tuberculosis is the second biggest killer worldwide.

AICROS Annual Meeting: insights and future perspectives

The Association of International Clinical Research Organizations (AICROS) is a network of small to mid-size CROs, which provide clinical research services to the pharmaceutical, biotech and medtech industries. Biomapas joined AICROS in 2014 and since then has been an active member of the association. On the 20-22 February, Biomapas’ CEO Audrius Sveikata participated in the AICROS Annual meeting, which took place in Tel Aviv, Israel. Audrius shared his insights about the meeting and the future perspectives of the association.